Tahoma Budget and Levy Impacts

by the Tahoma Values Team

After the EP&O levy failed in February 2024 by only 67 votes, the school board decided to run it again in April. That vote is coming up, and if you’re a voter in this district you should receive your ballot any day now.

Last week, we analyzed the impacts of a second EP&O levy failure on extracurriculars, including sports and clubs, as well as potential impacts to other groups in our community. This week we’re trying something a little more ambitious: We’re looking at the whole budget, and the impact a levy failure may have on our district.

This is a long article. If you don’t have time to read this, we’re hoping to put out an abbreviated version next week, for people who already know a decent amount of how school districts work.

First, a couple of caveats. We do not have any internal access to district accounting or finances, and are relying on publicly available information only. This is the same info that anyone else is capable of accessing, and we will provide all of the links and how to navigate them as we go. Second, we’re not professional accountants, lawyers, or budget administrators. We might get something wrong here, and we encourage you to take any clarifying questions to the district. You can email the PR Director, AJ Garcia, at ajgarcia@tahomasd.us. You can also find us on Facebook, Instagram, or Mastodon, or email us at TahomaValues@gmail.com.

2023 Budget Ad Hoc Committee Presentation

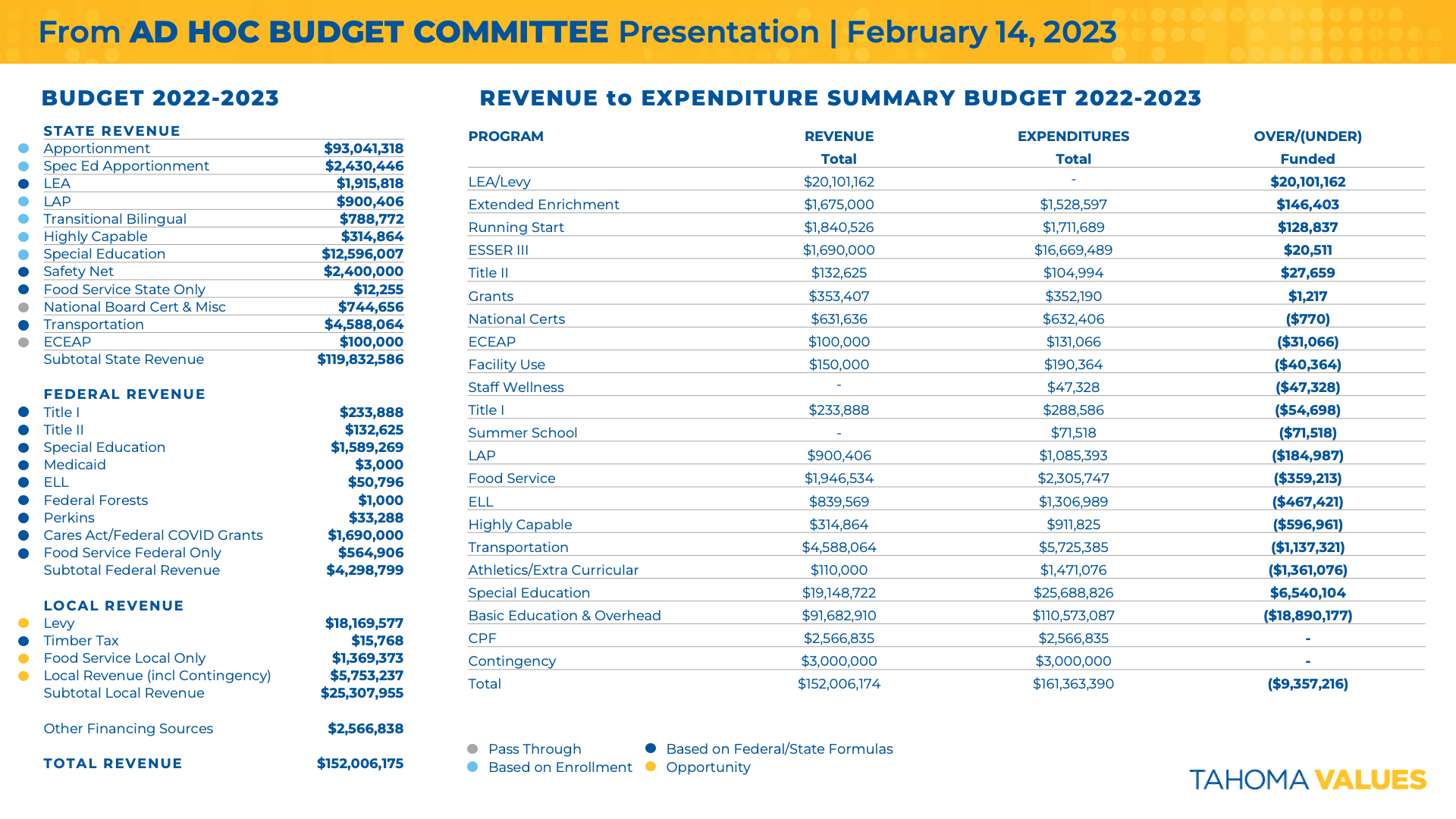

The school district convened a Budget Ad Hoc Committee a couple of years ago, consisting of a mix of community members, parents, and stakeholders in the Tahoma system. This committee made a presentation to the board in February 2023, where they discussed the overall budget, levy impacts on the budget, and the issue of unfunded and underfunded mandates. Here is the budget information, taken from the slides from that meeting:

Click these links for larger versions of the images: Budget, Mandates

The first slide shows the budget and the anticipated budget shortfall in that school year, 2022-23. The total shortfall, after the levy at that time, was anticipated to be ~$9.3 million (bottom right). The plan from the school board was to offset that shortfall by using general fund money. The general fund in prior years had been built up to such an extent that this board felt it was prudent to spend it down, rather than go to the voters to ask for more money. We discussed this in several prior articles. This extra general fund money is dwindling, which is why the board is now going out for a larger levy ask to fill the gap.

That same 2022-23 budget also shows where the levy money has been going. The left-most column under the “Revenue to Expenditure Summary” is the total funding coming from the state, the federal government, and fees like school lunch payments. The middle column is what the district actually spent that school year on those items. Then the right-most column shows the difference between the funding sources and what the district spent. (Note: Special education is a negative, not positive, $6 million.) The total negative number at the bottom is after the $20.1 million the district received from the levy that year.

For an example, take a look at Food Service. From the budget, we can see that the state funded $12,255, the federal government provided $564,906, and the district collected $1,369,373 in fees, for a total of ~$1.95 million. On the “Revenue to Expenditure Summary”, we see that the district was budgeted to spend $2.3 million dollars on this program that year, running a deficit of over $350,000.

The next slide is the list of unfunded and underfunded mandates. These are requirements that the district must fulfill, but that federal and state money does not adequately fund. The district has to rely on other sources to fund these mandates, like lunch money or, for large mandates like special education, levies.

The Actual Budget

If you don’t want to rely on the numbers coming from the district via presentations to the board, then another way to see Tahoma’s budget is to look at the official, legal budget. Public school districts in Washington state have to adopt a budget every year, and then submit it to OSPI. School districts in our state are then audited annually. (A note on this: Tahoma has received warnings on their audits in the past, which were usually minor clerical issues. Each time, they addressed the issue and went on to receive a clean audit. Here is the outcome of one such incident.)

One of the items that districts are required to report is the amount of money they’ve received and spent from local sources, that is, from local levies. (Tahoma does receive a very small amount in timber sales, as well.) This is called Supplemental and Annual Local Salary reporting and is governed by a Washington state law, which can be viewed here.

We’ve uploaded the full 2023-24 budget here, for convenience. Warning, it’s a 221 page PDF! We’ll be referring to this budget repeatedly in the remainder of this article, as well as to the reference codes contained within this document in section 6-31. These codes are necessary for making heads or tails of the budget, but we’ll explain what each one is as we go along.

For an example, search the budget for “Code 28”, which is the code for extracurriculars. You’ll find two entries: One is under certificated personnel on page 86, and shows the supplemental local (levy) salary to be $289,463. The second entry is under classified staff on page 110, with a local salary of $816,914.

On budget page 5 you can see the quick breakdown of where the district’s money goes, and we’ve included a summarized version below. The bulk of the funds go toward teaching, as you might have expected. For reference, the levy was anticipated to bring in just over $51 million over two years, so roughly $25.5 million/year, representing ~15% of the total budget.

| Total 2023-24 Tahoma budget | $164.9 million |

| Teaching Activities and Support | $123.4 million |

| Other Supportive Activities | $23.1 million |

| Building Administration | $7.9 million |

| Central Administration | $8.3 million |

State Funding and Unions

The Washington State constitution requires that the state pay for “basic education”. The definition of that term has been hotly contested over the years, and in 2007 the state lost a case in the state Supreme Court that accused the state of not meeting its constitutional obligation, and forcing school districts to rely on large levies to meet the obligation themselves. This was the McCleary case, and resulted in substantial changes to the state funding model for school districts. (Though it took over ten years for the legislature to finally come to an agreement on those changes.) One of the largest improvements was to the state’s portion of teacher pay.

The process resulted in an increase to the state level property tax for schools, and a reduction in the maximum allowed local levy tax that school districts could ask from voters. The new funding model can be seen here. In short, it provides certain staffing and materials funding for school districts, based on enrollment, the number of special education students, and some other considerations like the cost of living in that particular part of the state.

School districts now have more limits on how they can use levy funds, as well. For example, they can’t add money to, or remove money from, a teacher’s base salary – that is governed and paid for by the state now – but they can add extra money for extra work. This is usually called Time, Responsibility, Incentive (or TRI) pay. This is time spent outside of regular classroom time doing work, and varies by teacher.

As we discuss below, this allocation model provides far less than most districts feel is necessary for a quality education, especially in funding for paraeducators, nurses, counselors, coaches, and teacher pay, amongst others. The legislature understands this and has increased the cap on local levies several times since the initial McCleary bills were signed. Because state funding for education has not kept up with inflation, the legislature works every year to try to close those gaps. It’s an ever-moving target. (One of our own representatives here in the 5th legislative district, Lisa Callan, has a special interest in education and has proposed many bills on this subject.)

In the event of a double levy failure, all contracts in Tahoma have a clause that allows the district to reopen negotiations with that union. These are Public School Employees of Washington (PSE) for classified staff, Tahoma Education Association (TEA) for teachers and certificated staff, Tahoma Association of Athletic Coaches (TAAC), and Tahoma Association of Principals (TASP). The principals’ contract also contains a clause allowing them to rejoin the TEA union in positions “consistent with their experience and qualifications” in the event of reductions in force (RIFs).

Historically, union contract negotiations have gone pretty smoothly in Tahoma, with no strikes and both sides willing to make concessions. However, we have not had a double levy failure since the 1980s. This is nearly unprecedented, and we can’t predict how these negotiations would go in this situation.

Minimum Staff to Student Ratios

The state’s basic education funding requires school districts to abide by all state laws first and foremost, then sets allocations based on a model developed (and often tweaked) by the legislature. The allocation model is called the Prototypical School Model, which uses school sizes that are much smaller than Tahoma’s. Keep that in mind when looking at the numbers. For example, if the state allocates one principal for a 400 student school, an 800 student school would actually get two principals funded.

One of the requirements for funding is the ratio of teachers to students. The state law imposes a ground floor minimum, but the funding allocation model sets higher standards for full “basic education” funding specifically for grades K-3. The minimum teacher to student ratio at the K-3 level is 55.5 teachers per 987 students, or ~56 per 1000, in order to receive full funding. The fully funded “class size” is 17.78, with specialist teachers included in the final count. For the district to receive any state funding, the K-3 class sizes have to stay below a maximum of 25.23 students per teacher.

This means that our district can only cut a certain number of teaching positions before we start to lose state funding for teachers. However, this is not a binary situation – if the 17.78 ratio is not met, the funding works on a proportionate basis. It does not just turn off entirely. This is going to be a balancing act for the district, between what the state provides and what the district can save by removing a teaching position.

The absolute floor for teacher to student ratios is 46 teachers per 1000 students, per Washington state law, for the entire school district. This would require ~414 teachers here in Tahoma, vs the current 566 who are employed here. That means the district could remove 152 full time teaching positions and still technically be in compliance with state law, so long as they keep K-3 class sizes below ~25 students per teacher. In this scenario we would lose out on significant state funding under the school allocation model, and those state property tax dollars would not be refunded to local tax payers.

Doing the math, reducing the number of teachers to this extent would increase class sizes by an average of about six students per teacher, and even more in regular classrooms since the current averages include specialists like PE, STEM, Art, and Future Ready teachers. There would be larger increases in grades 4-12 to keep the K-3 numbers within the parameters of the law.

The state does also have some minimum requirements for the number of upper level, or Central, administrators vs the number of students: “6(b) The minimum allocation of staff units for each school district to support certificated and classified staffing of central administration shall be 5.30 percent of the staff units generated under subsections (4)(a) and (5) of this section and (a) of this subsection.”

Translation: For every 100 staff members that the state allocates in schools in the form of teachers, principals, and other personnel, then the district must have a minimum of 5.3 Central Services level administrators.

Theoretically the district might have more wiggle room when it comes to terminating or cutting salaries to administrative staff positions in the event of a levy failure, since the 5.3% allocation doesn’t say anything about the experience or education that these employees must have. The problem is that if they cut a position that the state is paying for then they will lose all of that state funding along with it. They can’t legally use money that’s supposed to be spent on a central administrator for, say, 10 paraeducators instead. We’ll take a peak at how the levy impacts these salaries below.

Unfortunately, the situation is bleak for paraeducators (often shortened to “para”) and other staff when it comes to minimum staffing levels. The state has very few requirements for access to a paraeducator for students. The allocation model pays for just 0.936 staff per 400 elementary students in the form of “Teaching assistance, including any aspect of educational instructional services provided by classified employees.” At a typical Tahoma elementary school with 700 students, that’s just 1.6 paraeducators for the entire building. (Anecdata: Some of us have volunteered in elementary classrooms with two paraeducators assigned to ONE class. Recess teachers are also, typically, paras, and there are several at each school.)

For students with special education needs, the district receives a multiplier in extra funding that roughly doubles the state funding for those students. But even if the entire, hypothetical 700 student school were funded at that rate, they would still only be able to retain 3.2 paraeducators. This is far fewer paras than the district currently employs, and we anticipate this being a large source of losses in district personnel. Other non-instructional staff are in a similar boat, and we anticipate big losses there as well.

Salary Cuts

While any potential position terminations are speculative, what we know will definitely be cut is the levy-funded portion of everyone’s salaries. We return to the budget to get an idea of what these cuts would look like. Under Code 27 on page 86 of the budget, there are 389 full time equivalent (or FTE) of teachers receiving over $6 million of supplemental pay from the levy. When you add in Code 22 for library media specialists, Code 28 for teacher extracurricular pay (later in the budget you can see that classified staff also receive extracurricular pay, and more of it), and Code 33 which includes specialist teachers, the total comes out to over $7 million.

$7 million of the EP&O levy goes straight to our teachers

The portion of a teacher’s salary that will be lost varies. We’ve heard from teachers around the district who are expecting anywhere from a 7% to 12% or even a 17% cut to their salary if the levy fails again.

In other positions, you can see that under Activity Code 24 there are 21 full time equivalents (FTE) of counselors who are in total receiving over $400,000 in supplemental pay. This could represent supplemental pay for each counselor, or could represent entire positions that are paid by the levy. On page 126, 11.3 FTE of Aides associated with the Early Learning program are receiving over $560,000 in supplemental pay, an amount that represents almost half of the salary allocated to this group of employees.

Admins also receive a stipend to their pay, via the levy, that will have to be cut. Our elementary and secondary principals are receiving an additional $470,448 (code 23), for example. Speaking of admins:

Will Any Admins Get Fired?

This has become a popular question, and it’s kind of hard to answer with the info we have available to us. We do think that there will be losses to administrative staff, with most of that likely to be to classified staff. Here’s what we have to go on.

Tahoma currently only has 28.6 certificated administrative staff, who are our principals and assistant principals, but can also include “those persons who are chief executive officers, chief administrative officers, confidential employees, (and) supervisors,” according to this RCW. This does include the superintendent.

There are additional administrative staff who fall under classified staff, like front desk secretaries, nurses, school registrars, support staff at Central Services and Transportation, school deans, and so, so much more. There are 88 positions in Tahoma labeled “Office/Clerical”, and includes people all the way from the top offices with the current CFO, Bill Hernandez, to front office staff in the schools and Teaching & Learning secretarial staff. There are another 19 people listed under Other Support Personnel, which appears to mostly be Deans. These are just two of the labels that are used for admin staff in the state system. Administrative staff includes potentially hundreds of people in Tahoma.

While many of these positions may be fully covered by the levy, some administrative personnel also receive additional stipends that are paid by the levy. For example, while we find it doubtful that many principals would be fired in the event of a second levy failure, as the majority of their salaries are paid by the state, a portion of their pay does come from the levy. You can see the total levy expenditure for principals on page 85 of the budget, which is $470,448. (Activity Code 23 is for the Principal’s Office.)

We know that when most people say “admin” in this context they actually mean upper level administrative personnel who run the district, like the superintendent, so let’s look at that. On page 106 of the budget under the section for Certificated Employees who provide district-wide support, you can see that the office of the Superintendent (code 12) receives a total of $34,028 from the levy, and Human Resources (code 14) receives $44,611. All in, the upper level certificated admin in Tahoma appear to be receiving just $78,639 in extra pay via the levy, with the rest of their salaries covered by the state.

While, again, there is likely wiggle room in terminating these positions, the district would lose whatever funding we are receiving via the state allocation model for any positions that are cut. It is also state law that school districts retain a superintendent, and Tahoma just signed a contract with incoming Dr. Ginger Callison.

The rest of upper administrative pay appears to mostly be paid by the state. There are some entries under classified personnel for “Director/Supervisor” but only one entry has extra pay from the levy. On page 126 there is $22,500 for this category under the Early Learning department. There are many entries for clerical and office staff, however. The largest is under a code for Information Systems on page 129 for $129,146 with an additional $8,000 under other salary items.

If all building and district level administrative personnel were fired the district would cut $18.4 million from the budget, with most of that resulting in an equal loss in state funding. Even if it all came from the levy, the levy was expected to bring in $7 million more than that, so cuts elsewhere would still be necessary, and we would no longer have the personnel with expertise to even do the budget.

OK, But What Will be Cut at MY Kid’s School?

This is where we at Tahoma Values run out of information. We can speculate until the cows come home, but we can’t tell you whether your kid will have a STEM class next year.

For example, we know that of the nearly $1 million spent on the Highly Capable program, only $320,000 comes from the state. Something – many things, probably – will have to be cut, but what? Will we lose the Discovery Program? AP courses and college in the classroom for the high school (or the teachers who can teach them)? Will all AP classes be cut, or only some of them?

We know specialist teachers in the elementary schools are receiving levy funding, but does that mean that entire positions will be cut or that those teachers will “just” lose some of their pay? (We put that word in quotes because we know this is a horrible situation for teachers. There’s nothing “just” about this.)

With the expected loss of paraeducators (the district said that ~120 classified staff would be let go if both levies failed, and paras fall under that umbrella), will elementary students lose one or more recesses? What will lunch look like at the elementary and middle schools?

If we go back to six periods at the high school, what does a student do if they fail a class and can’t achieve the Washington state requirement of 24 credits to graduate? Summer school is also not funded under basic education.

On and on. The district has provided some general information on this, which we included in a prior article: “Programs/areas that would be specifically impacted: Curriculum offerings at all schools, EEP, food service, grounds maintenance, professional development and training, Camp Casey and other field trips, AP and CTE offerings, clubs, activities, athletics, high cap program, safety and security, wellness, and the 8 period day at the high school.”

And in other worries, what will happen to this community as property values drop due to an underfunded school district?

Final Thoughts

On a personal note, we at Tahoma Values support our teachers, staff, and yes, even most of our administrative staff. After the inflationary period of the past couple years, and in light of the current atmosphere of large pay increases for union workers across the country, we understand why the teachers and staff in Tahoma are very upset by these potential pay cuts and job losses. We anticipate many high quality staff and educators will leave our system because of this. We already compete with other districts, and offer less pay than almost any district around us. This will put us further on the back foot in hiring and retaining talented people.

If you have a Tahoma employee in your life, please treat them with kindness. Always, but especially right now.

This article was a collaborative effort of the Tahoma Values Team. If you’d like to submit something to publish on our site, please email us at TahomaValues@gmail.com. You can also find us on Facebook, Instagram, and Mastodon.